About Us

Quantum

We are an independent price reporting agency (PRA) providing price assessments, original news and trade data for the global energy transition markets.

Our mission is to bring greater transparency to these rapidly developing markets, powering transactions and helping the world to decarbonize as efficiently as possible.

The Challenge

The global energy system needs to change at an unprecedented pace if the world is to get close to meeting commitments to cut greenhouse gas emissions made under the Paris Agreements in 2015.

However, oil is likely to remain in widespread use as low carbon technologies mature and new environmental policies and markets emerge. Science will drive the debate; but energy news, pricing and data will be at the forefront of decision making underpinning this transition.

That's where we come in.

From crude oil to biofuels, carbon offsets and zero-carbon ammonia, Quantum joins the dots between all points of the energy and emission chain to enable the transition to a greener, cleaner world and help our customers make assured and better informed decisions.

What we do 2 week trial

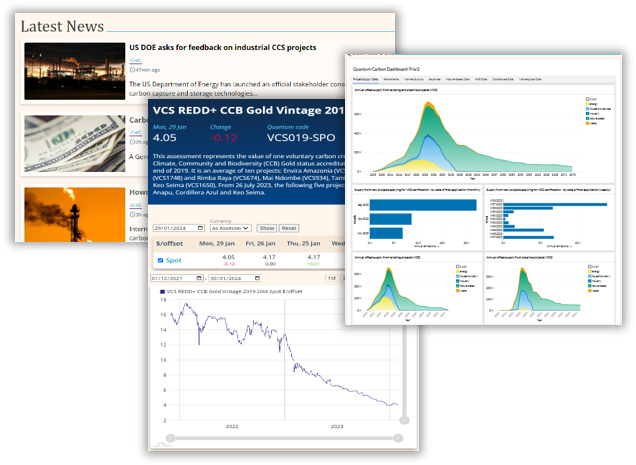

Quantum publishes original real-time news and market commentary, price assessments and fundamental data, guiding market participants through changes to policy, technology and supply / demand scenarios.

Our daily market prices for oil, biofuel, carbon credit, ammonia and hydrogen are used as references in trading contracts as well as for risk management, analysis, accounting, taxation and more.

Locations

Headquartered in London with offices in Dubai, Singapore, Paris and the USA, Quantum has unrivalled knowledge of the energy transition markets, and is the leader in carbon credit price discovery and carbon market news.

Leadership

Our experienced management team have worked at, and founded, price reporting agencies, developing pricing benchmarks and managing commodity news and data teams.

We are always looking for great people to join us.

Clients

Our clients include major energy companies, trading houses, financiers, carbon project developers, transportation industry, technology and manufacturing companies, governments, consultants and service providers.

"It’s a fantastic service, the first thing

I check each day."

Analyst at a European energy supplier

"Quantum sets the standard for

carbon market price assessments."

Energy company trading department

"The team relies on Quantum’s

insights to keep up to date with the market."

Head of Sustainability at a large airline

Partners

Our clients can also access Quantum's news and price assessments via these partner platforms:

To make Quantum data available on your platform, contact us