Corsia Phase 1 Conditional Offtake

This assessment reflects the price of a carbon credit compliant with the first phase (2024-2026) of Corsia, the UN aviation mechanism to limit growth in airline emissions, and traded in the forward delivered market. Under the 'conditional offtake' mechanism, seller makes best efforts to deliver carbon credits tagged with a 'Corsia phase one' label by a relevant registry by the end of the calendar year, to the final buyer. If the initial delivery cannot take place for reasons of Corsia eligibility, seller retains option to deliver alternative credits or cancel the transaction. Both 'year plus one' and 'year plus two' contracts are covered in order to reflect the different delivery periods traded OTC. All carbon credit types are covered, although Quantum intends to settle the basket on the cheapest carbon credits eligible. A typical deal size of 100,000 tonnes of CO2 equivalent is reflected. The price of smaller deal sizes may be normalised downwards and bigger deals normalised upwards.

Currency and unit of measure: $/tCO2e

Incoterm: REG

Quantity: 100,000

Time of assessment: 12:00:00 UTC

Publishing frequency: Daily

Spec:

Start Date: 08.09.2025

Please Register or Sign in to view this content.

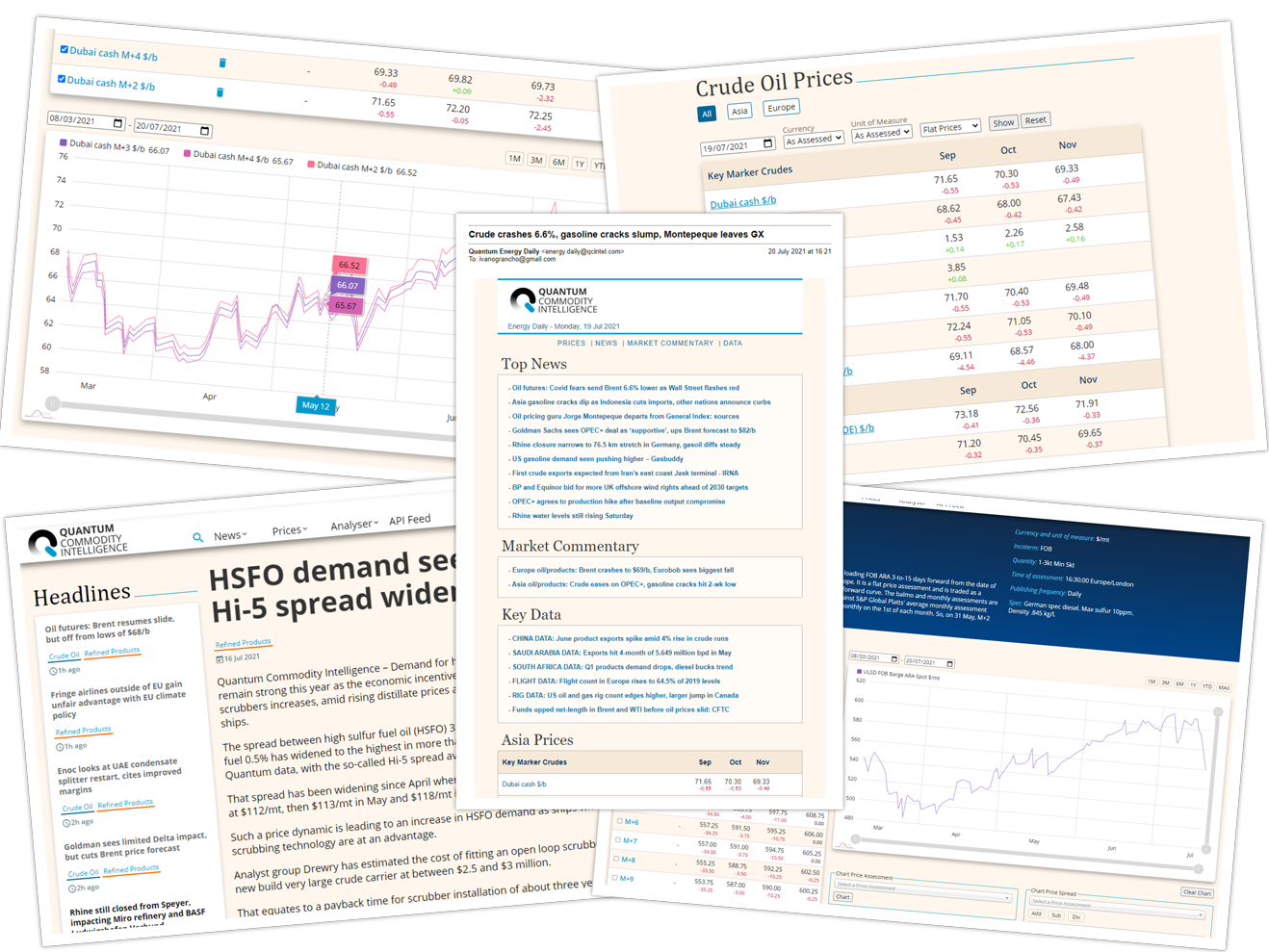

Quantum Commodity Intelligence is a premium paid subscription service for professionals in the oil, biofuels, carbon, ammonia and hydrogen markets.

Quantum Carbon service subscribers have access to:

- Daily price assessments

- Market news and price commentary

- Fundamental trade data

- Quantum Carbon Daily - market report sent to your email

Get in touch with us for subscription information on all Quantum platforms, or help with the service.