Naphtha east-west spread

This swap-spread reflects the value of naphtha CIF Japan swaps minus the value of naphtha CIF NWE swaps at the Singapore cash market close, normally 1630 Singapore time. It is a key indicator of arbitrage opportunities, typically from Europe to Asia and is used by exporters of naphtha in the Middle East and Europe. Swaps are financially-settled against S&P Global Platts' average monthly assessment published on the calendar month in question. The swaps assessments roll monthly on the 1st of each month.

Currency and unit of measure: $/mt

Incoterm: SPR

Quantity: 5,000 mt

Time of assessment: 16:30:00 Singapore

Publishing frequency: Daily

Spec: Min 65% parrafin.

Start Date: 17.02.2022

Please Register or Sign in to view this content.

Quantum Commodity Intelligence is a premium paid subscription service for professionals in the oil, biofuels, carbon, ammonia and hydrogen markets.

Quantum Oil service subscribers have access to:

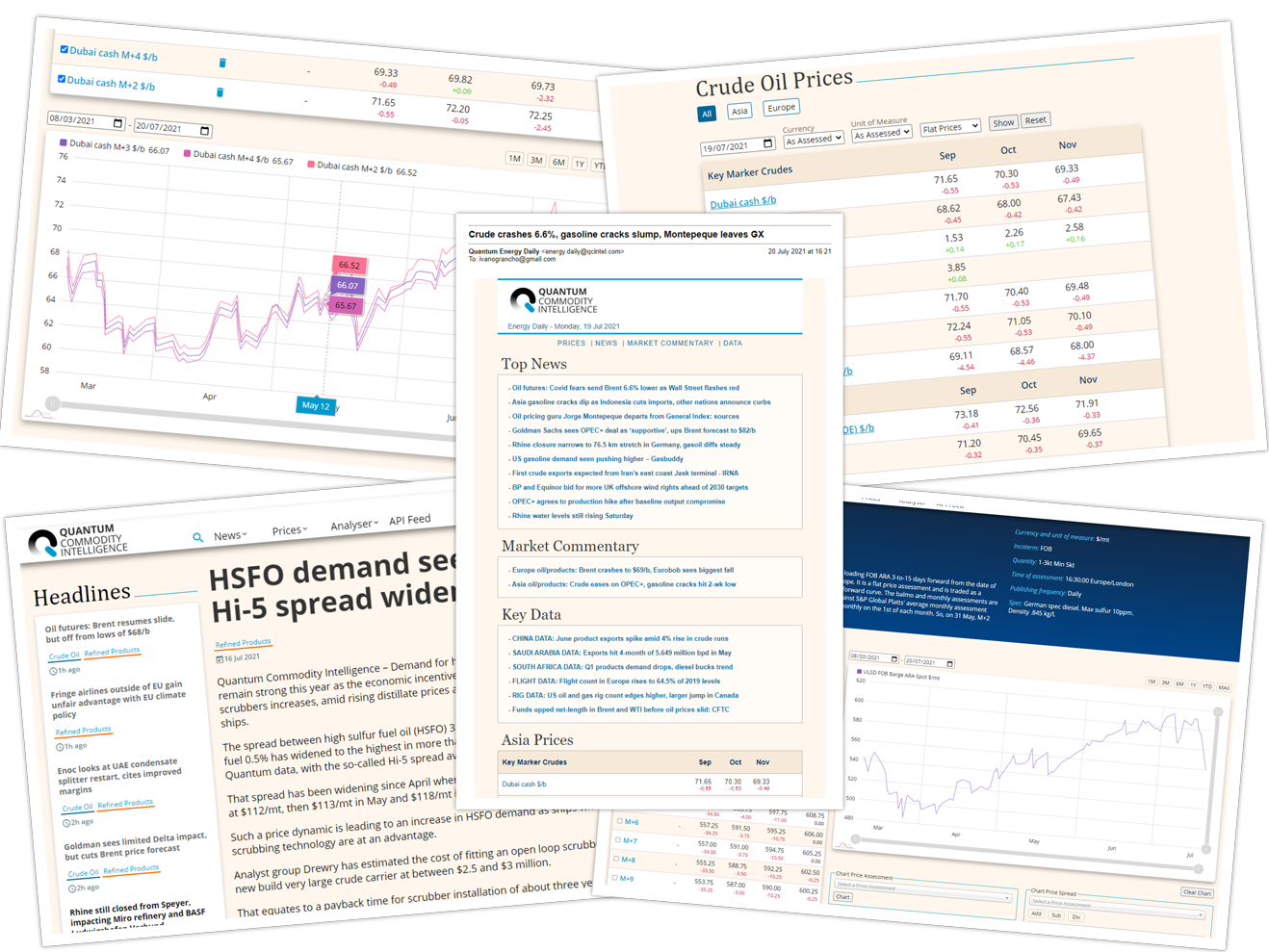

- Daily price assessments

- Market news and price commentary

- Fundamental trade data

- Quantum Oil Daily - market report sent to your email

Get in touch with us for subscription information on all Quantum platforms, or help with the service.